As the leading enterprise of high-value medical consumables in China, the follow-up performance of Kantley will be affected, and it will also be a haze for the company's stock price.

On January 14, Kang Delai was affected by the news that the company's third largest shareholder, Jianyin Medical Fund, planned to clear its holdings within six months. The stock price fell 6.2% at the highest, and fell 5.91% at the close. 27 yuan / share.

On the evening of the 13th, Condella announced that the shareholders of CCB Medical Fund, which holds 6.44% of the shares, plan to reduce the company’s shares in a legal manner approved by the Shanghai Stock Exchange, such as centralized bidding, block trade, and agreement transfer, within six months. 28.418 million shares, that is, no more than 6.44% of the company's total share capital.

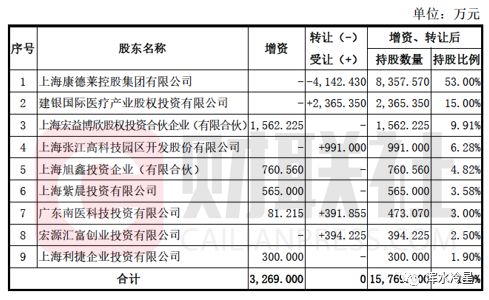

According to the Kantley prospectus, the CCB Medical Fund entered the company when it was transferred to Shanghai Condella Holdings in August 2010. At that time, it was transferred at a price of 4 yuan per 1 yuan of registered capital. The shareholding cost of the medical fund is 4 yuan / share.

According to the prospectus, CCB Medical Fund held the company's 2,635,500 shares (accounting for 15% of the company's total share capital) at a cost of 4 yuan before the listing of Kantele, becoming the second largest shareholder of the listed company.

Figure|The specific situation of the equity transfer of Kangdelai in August 2010, source: company prospectus

On April 21, 2016, Condella landed on the main board of the Shanghai Stock Exchange. The CCB Medical Fund promised not to reduce its holdings within 12 months after the company's stock was listed. One year expires, on November 24, 2017, Kantley announced that the CCB Medical Fund intends to reduce the holding of 18.9261 million shares, that is, no more than 6% of the company's total share capital.

The Financial Association's inspection of the top ten shareholders of Condella found that the 2017 annual report showed that the number of shares held by CCB Healthcare Fund decreased by 1,584,600 shares, and its shareholding ratio declined. Until November 5, 2018, CCB Medical Fund reduced its shareholding in the company by 4.416 million shares, and its shareholding ratio fell to 6.44%, from the company's second largest shareholder to the third largest shareholder.

From the release of Kantley's listing of shares for one year to the latest reduction announcement yesterday, CCB Medical Fund is eager to reduce its cash, perhaps because the stock price is not waiting. Since the listing, Condé has 14 consecutive daily limit, setting a record high of 22.31 yuan / share, the stock price will plummet. On November 21, 2017, the shareholder's initial share pledge expired. The company's share price closed at 9.2 yuan/share, which is already below the issue price of 9.5 yuan/share. Based on today's closing price, it has fallen 71.9% from its historical high.

If the company's share price continues to fall, it will be close to the shareholding cost of the Bank of China Medical Fund of 4 yuan per share, which can explain why it is eager to reduce its holdings. At the same time, the negatives of shareholder reduction are fermented in the secondary market, and the company's share price is under pressure in the short term.

In addition, the company's performance may also face pressure. Kantele is a manufacturer of medical puncture devices. Its main products include medical puncture devices, medical polymer consumables, and interventional consumables. With the pilot of centralized drug procurement in the country, provincial-level centralized procurement of high-value medical consumables and cross-regional joint procurement have also been put on the agenda.

On December 12, 2018, the Shaanxi Provincial Public Resource Trading Center issued the "Notice on Issues Concerning the Purchasing of Medical Consumables for Pharmaceutical Products", clarifying that the relevant departments for the procurement of pharmaceuticals and medical consumables in the Center were adjusted by the Shaanxi Provincial Health and Health Committee to the Shaanxi Provincial Medical Center. Security Bureau. That is to say, the Shaanxi Provincial Medical Insurance Bureau has become the first national case to officially accept the “handover stick†for the purchase of medical consumables.

As early as the establishment of the National Health Insurance Bureau, a number of provinces and cities began to explore the centralized procurement of medical supplies. Shaanxi Province is at the forefront, and its “Western Alliance†for consumables procurement has become a super-supervisor covering 14 provinces including Shaanxi, Sichuan, Inner Mongolia, Ningxia, Gansu, Qinghai, Xinjiang, Hunan, Heilongjiang, Liaoning, Guangxi, Guizhou, Hainan and Tibet. Major league.

The 14 provinces medical consumables procurement alliance produced synergies, the price of consumables in one province declined, and the price linkages in the remaining 13 provinces declined. The centralized procurement of consumables initiated by various provinces and municipalities is based on the purchase price of the 14 provinces, and then the price is negotiated at a price. The form is similar to the purchase of drugs.

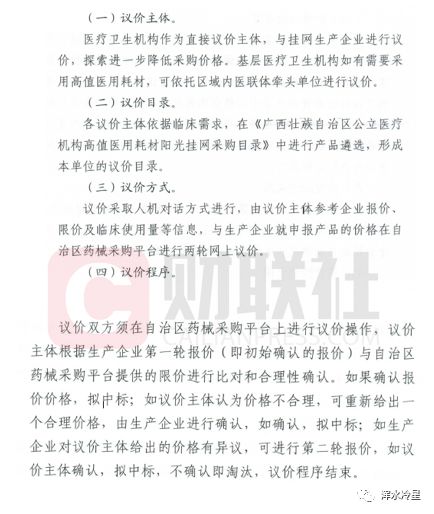

Taking the Guangxi Zhuang Autonomous Region as an example, it plans to implement the procurement of the 13 categories of high-value consumables in batches within the whole district. The medical and health institutions as the main body of negotiation, refer to the quotation, price limit and clinical use of the production enterprises. Two rounds of bargaining with the production company on the procurement platform.

In terms of specific bargaining, the medical and health institutions shall compare and determine the rationality of the first-round quotation (ie, the initial confirmed quotation) of the production enterprise with the price limit provided by the drug procurement platform of the autonomous region. If the quotation price is confirmed, it is proposed to win the bid; if the negotiating entity believes that the price is unreasonable, a reasonable price may be re-submitted, and the production enterprise confirms it, if confirmed, it is proposed to win the bid; if the production enterprise has objection to the price given by the negotiating entity, The second round of quotation, if confirmed by the bargaining entity, is intended to be won, and will be eliminated without confirmation, and the bargaining process ends.

Figure|Guangxi Zhuang Autonomous Region procurement of high-value consumables, source: "Guangxi Zhuang Autonomous Region high-value medical supplies sunshine procurement implementation plan (draft for comments)"

Guangxi is currently only a microcosm of the 14 provinces and may represent more provinces in the future. It is clear that the price reduction of medical consumables is imperative.

From 2015 to 2017, Kantley's net profit was 94.555 million yuan, 101 million yuan, and 119 million yuan, with an average annual compound growth rate of 12%. Earnings of 1.13 in the first three quarters of 2018. 100 million yuan. The performance of listed companies in the past three years has been outstanding, but as the leading enterprise of high-value medical consumables in China, the follow-up performance of Kantele will be affected, and it will also be a haze for the company's stock price.

[Finance News Agency] (researcher Zhu Jiechi)

Fresh Half Shell Mussel Meat,Half Shell Mussel Meat,Frozen Cooked Mussel Meat,Frozen Mussel

Shengsi Xiangyuan Aquatic Products Co.,Ltd., , https://www.xiangyuan-aquatic.com